Invoice List contains all

sales invoices for a customer.

- Sales invoices from LinkPOS is updated in

the "Invoice List" with status as "PRSD" (Processed)

- Users can add a new invoice in the Invoice List.

This invoice with will signed for "Tax

Monitoring System " if the

SDC integration is enabled.

Steps to setup create invoices :

-

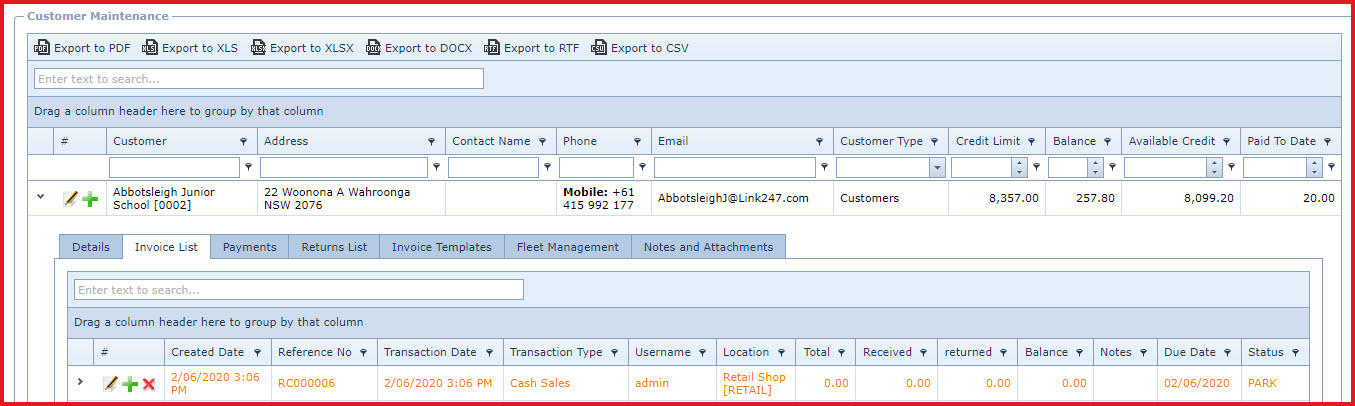

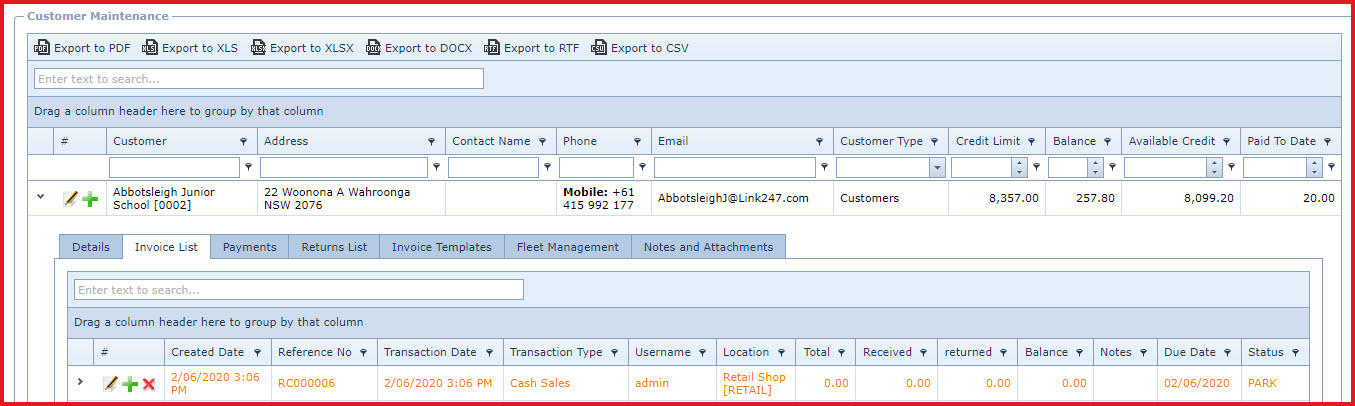

Select the

customer and expand

into the details.

-

Go to the

"Invoice List" tab:

-

Click on

"Green Plus Sign". This will open the edit form.

-

Enter below details

-

Reference No - The "Reference Number" is system

generated.

-

Location - Select the location or

warehouse.

-

Transaction Date - Enter the invoice date

-

Transaction Type - Select the transaction type.

These includes:

-

Cash Sale

-

Credit Sale

-

Lay- By

-

Quotation

-

Due Date - Enter the date the payment is due for the

invoice.

-

Notes - This is an open text field. Users can enter

desired content.

-

Save. Click on the Floppy Icon. This will

create the transaction header with status as "Park". Refer to

Figure 1.

-

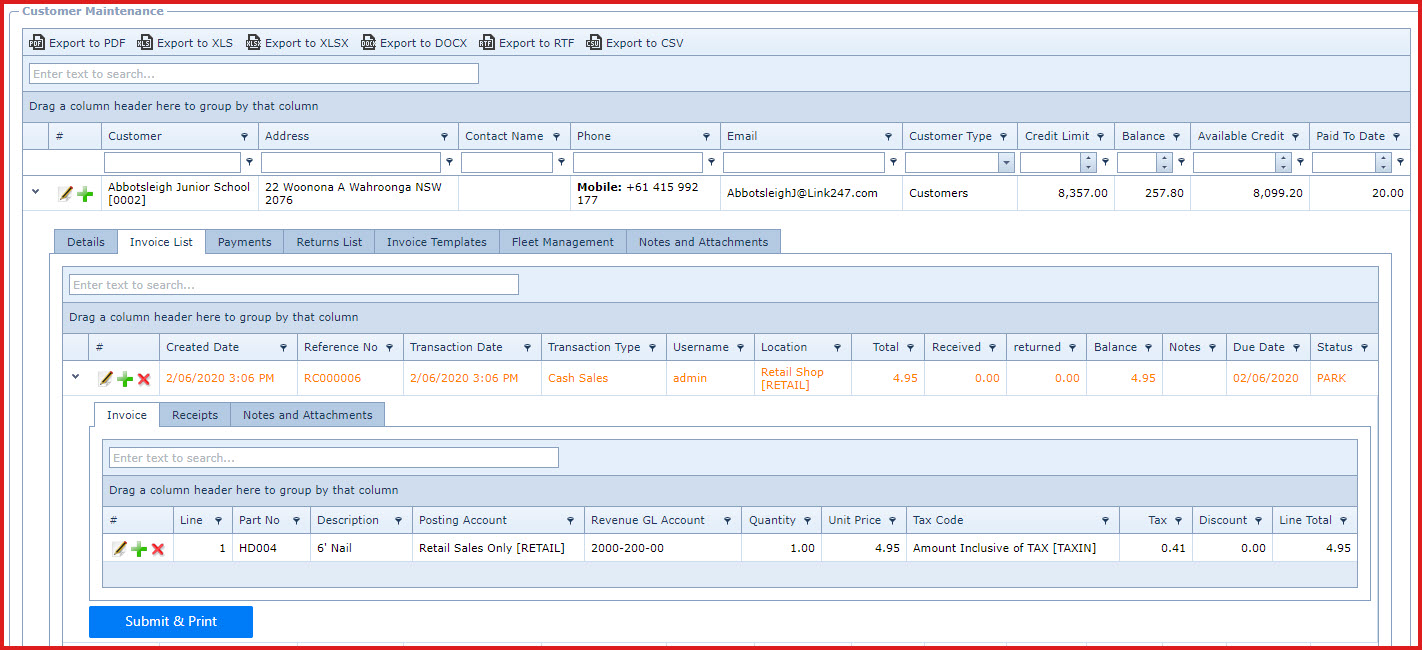

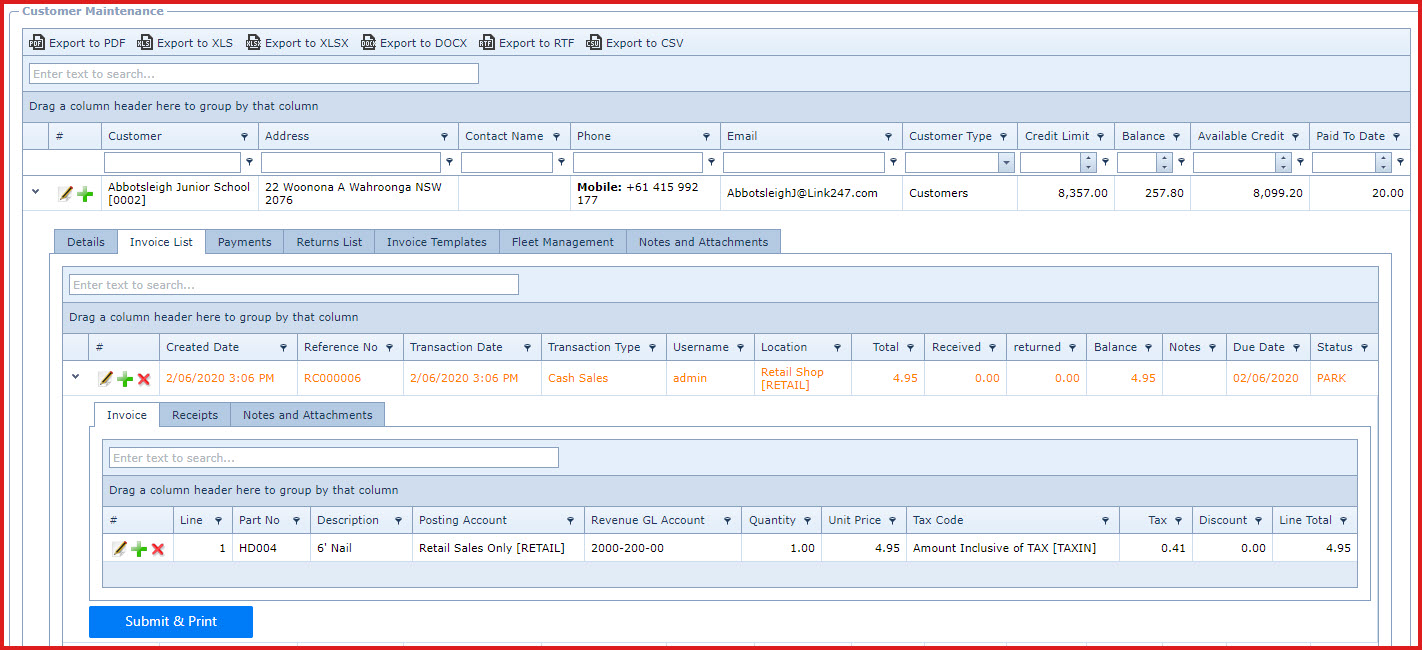

Click on the "Grey Arrow" next to

the transaction. This will load the details of the invoice.

-

Go to the "Invoice" tab

-

Click on "Green Plus Sign". This

will open the edit form.

-

Enter below details:

-

Part No - Select the product for the invoice.

-

Description -

The description of the product

is auto

updated.

-

Tax Code - Select the

sell tax

rate.

-

Posting Account - Select the general

ledger "Posting Account" for the invoice.

-

The general ledger account from the

posting account is used to integrate the invoice into ERP systems.

-

Posting accounts are maintained under "Linkweb

- Inventory - Posting Account"

-

Revenue GL Account - Select the "Revenue GL

Account" for the invoice.

-

Revenue GL Accounts list is

integrated from ERP systems

-

Quantity - Enter the sell quantity.

-

Unit Price - Enter the selling price.

-

Discount - Enter the discount amount. The

discount is entered as a dollar value. For

example,

-

Unit Price is $10.00

-

Discount is $2.00

-

New Selling price will $8.00

-

Save.

Click on the Floppy Icon.

-

Go to the "Receipts" tab - Enter any payment received for the invoice.

-

Click on "Green Plus Sign".

This

will open the edit form.

-

Enter below details

-

Payment Date - Select the

payment

date

-

Payment Type- Select the payment

method. Payment method is maintained

under "Link Point of Sale

-

Payment"

-

Description - Enter the payment

description.

-

Amount - Enter the payment

amount.

-

Save. Click on the Floppy Icon.

-

Click on the "Submit and Print" button.

-

This will save the

invoice and generate the receipt.

-

If TMS is enabled, data will

be transmitted for signing. System

will generate a "Fiscal invoice".

-

The status

of the invoice will be updated to "CLOD" (Closed).

Figure 1: Invoice

Header

Figure 2: Invoice

Details

Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation